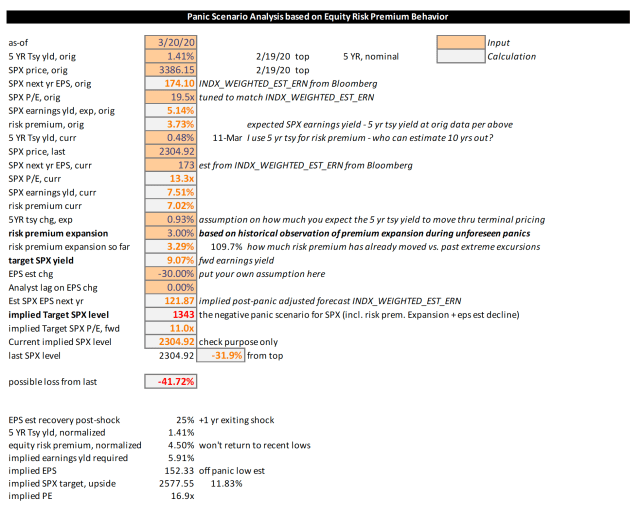

Looks like I was ‘ahead of the curve’ on this one and did a decent job of guesstimating the expectations of effects on earnings.

A Goldman, Sachs update calls for a 33% decline in EPS.

It could end up worse or better, but for the moment, looks like my downside figure was a decent early estimate of the negative possibility.

It’s my personal view that the government (Federal and State) response to this exogenous event is now actually doing more damage than we’d see from the virus in the first place. This kind of irrelevant as I’m making investment evaluations in this thread of postings and that has to take into account policy actions.

Looking at the post-crisis upside potential, in the short term from a bottom ( i.e. 1 yr expectations out from a bottom ), my scenario puts a roughly 2500-2600 ‘fair value’ on the SPX including the effect of a +25% rebound in EPS.