The NY Fed has rapidly reversed out it’s outstanding TOMO levels in just the last few days by conducting successively larger Reverse Repo operations with any of qualified Banks, GSEs or Money Market Funds. There has been a massive rush out of corporate bonds and stocks, of course.

Concurrently, the Fed has been busy redeploying the funds, and then some into POMO – or QE-Infinity as some are calling it now, not to mention, very importantly, Central Bank Liquidity Swaps for which we finally got the first week’s worth of activity ending 03-25-20. A mere $200 bn 😉 Still, USD funding looks tight.

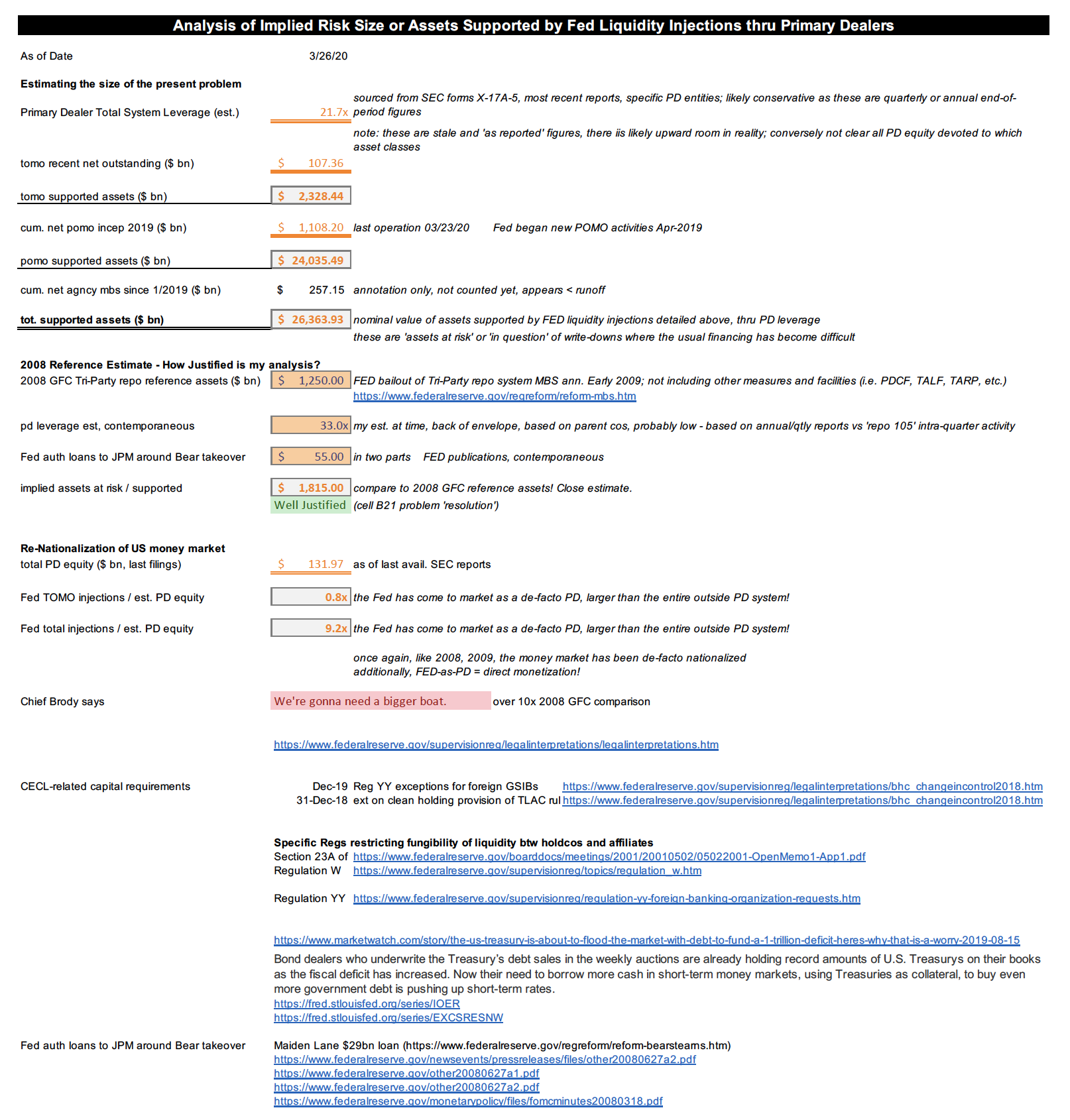

[Note: this chart and the file are as-of 03-27-2020 despite their label. will be corrected]

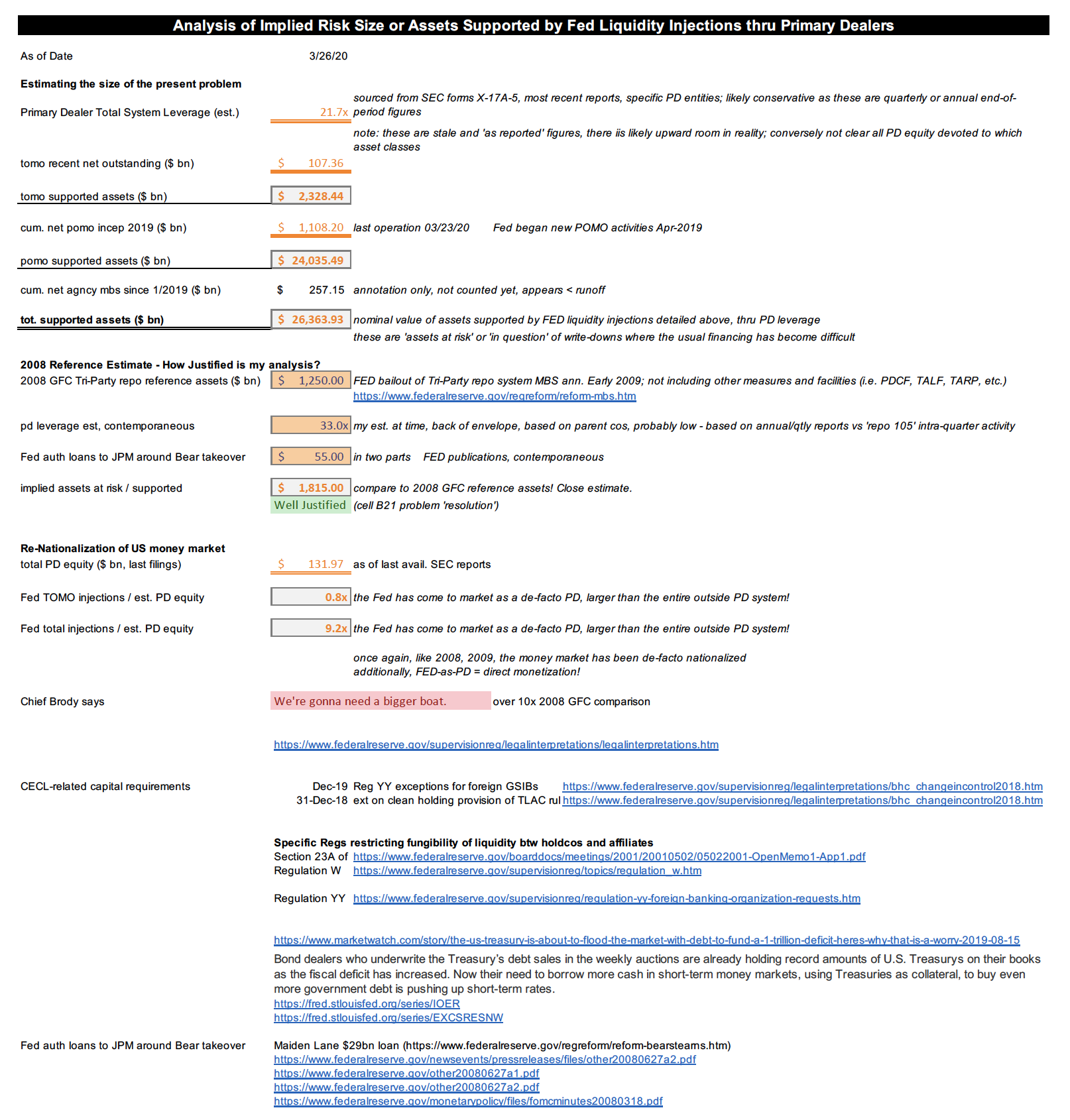

repo-analysis.-20200327

Despite the announced CPFF, all appearances are the commercial paper market is still in distress, regardless of how good the recent snap-back rally in stocks might make you feel. There’s been a massive run by corporations to draw down bank funding lines, exceeding even the GFC of 2008.

Similarly, despite the announcement of support for ABS and the MBS markets (commercial mortgages), an examination of the changes in the weekly holdings of the Fed’s SOMA shows little net buying there yet, while POMO has caused holding of notes and bonds to explode upward propelling the Fed’s balance sheet to new highs.

I categorically DO NOT BELIEVE the assurances from various financial market pundits and authorities that despite the economic crisis induced by the pandemic, this is not a financial crisis like 2008. It is EXACTLY so, based on all this activity we’ve now seen to date. And the reason is financial crises do not cause economic crises (as far as I am able to tell from reading historical accounts and studying data from more recent US history from 1917 on). Causation is always the other way. The financial crisis is merely the financial system and asset prices catching on to economic reality.

The only question is can the US Treasury and the Fed, with the benefit of our savings, keep the financial system standing up.

Take your pick from among estimates being circulated of the total cost of this bailout. From the $2 trillion of the recent bill, to estimates such the Fed’s balance sheet going $9 trillion this year (at the rate they are going, I could believe it).

Now, do those multi-trillion estimates of assets ‘in trouble’ implied by the Fed’s TOMO and POMO activities over the past fews months I’ve been pointing out make some sense to you?

Stay Healthy!